If you’ve received or are expecting a personal injury settlement, one important question to consider is whether that money is taxable. While many personal injury settlements are not taxed, there are exceptions depending on how the compensation is categorized.

At Hillstone Law, we help our clients understand not just how to secure maximum compensation but how to manage it wisely, including tax implications. Here’s what you should know about how the IRS views personal injury settlements.

Are Personal Injury Settlements Taxed?

The short answer: some parts are, some aren’t.

The IRS treats each portion of your settlement differently based on what it’s intended to compensate for. Let’s break it down.

Compensation That Is Generally Not Taxable

1. Medical Expenses

Any compensation you receive to cover medical bills directly related to your injury is typically not taxable.

Example: If you suffered a broken arm from a slip-and-fall accident and received $15,000 to cover treatment, that amount is usually tax-free.

2. Pain and Suffering (Linked to Physical Injury)

If your emotional distress or pain and suffering stems from a physical injury, the related compensation is not taxed.

Compensation That May Be Taxable

1. Medical Expenses Previously Deducted

If you claimed a tax deduction for medical expenses related to your injury in a prior year, and then received a settlement reimbursing you for those same costs, the reimbursed amount becomes taxable income. This must be reported on your Form 1040 under “Other Income.”

2. Lost Wages

Payments meant to compensate for lost wages or income are taxable, just like regular wages. These must be reported as income and are subject to income tax, Social Security, and Medicare tax.

3. Pain and Suffering (Not Linked to Physical Injury)

If you’re compensated solely for emotional distress that isn’t connected to a physical injury such as workplace stress or harassment that portion is taxable.

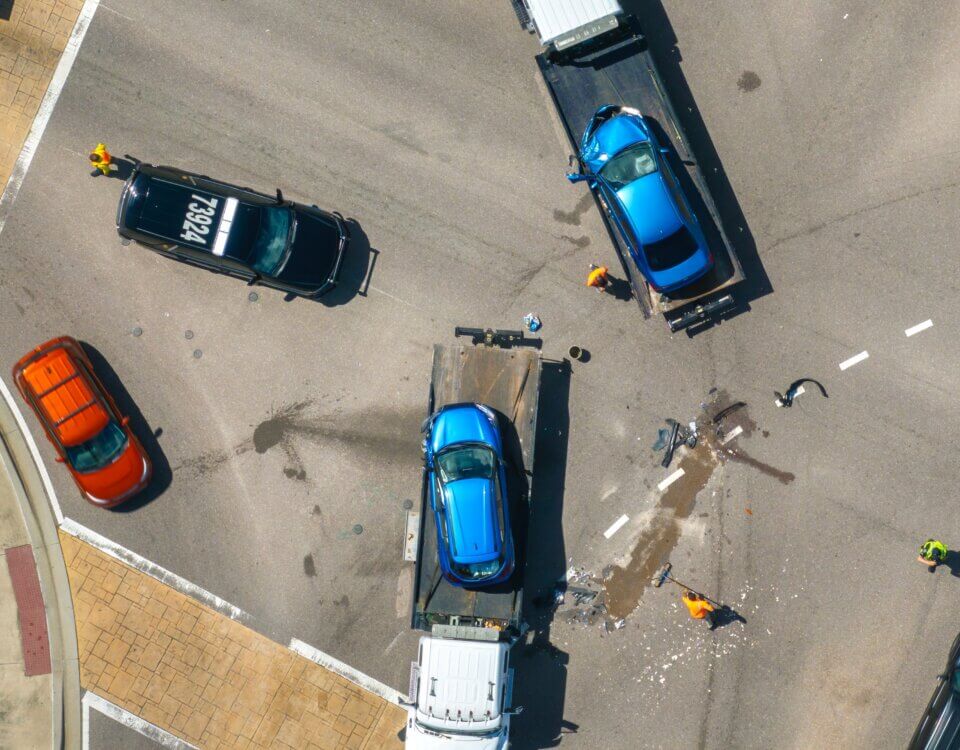

4. Property Damage

If you receive compensation for property damage (like damage to your car or home), that amount is not taxable unless the amount exceeds the value of the damaged property, in which case the excess is treated as capital gains and is taxable.

5. Interest on the Settlement

If your settlement includes interest (e.g., from a delayed payment or structured settlement investment), that interest is taxable and must be reported as interest income on your tax return.

6. Punitive Damages

Unlike compensatory damages, punitive damages are always taxable, regardless of what the lawsuit was about. These are reported as “Other Income” on your tax return.

Is a Court Judgment Taxed Differently from a Settlement?

No. Whether your compensation comes from a settlement agreement or a jury verdict, the tax treatment is the same. What matters is what the money compensates you for, not how it’s awarded.

How to Reduce Tax Liability on a Personal Injury Settlement

Working with an experienced attorney can help you minimize or even eliminate the taxable portion of your recovery. Here’s how:

- Break down the settlement clearly: By specifying how much is allocated to medical bills, emotional distress, lost wages, etc., your attorney can help clarify which parts are non-taxable.

- Avoid deductions you may need to repay: Be cautious when claiming itemized medical deductions on prior tax returns if your case is still open.

- Consider structured settlements: In some cases, spreading your payments over time can reduce tax burden and help manage long-term finances.

- Consult with a tax professional: Especially in high-value or complex cases, it’s wise to get tax planning advice before finalizing your settlement.

Hillstone Law Can Help Maximize and Protect Your Recovery

Securing fair compensation is only part of the process. At Hillstone Law, we help clients across California not only pursue personal injury settlements but also understand how to preserve the full value of those funds.

If you’ve been injured and are negotiating a settlement or wondering about the potential tax consequences contact Hillstone Law today for a free consultation. We’ll guide you every step of the way.